4935:TW Key MacBook component maker with TEV/EBIT <2.6 & dividend yield 8%

Global Lighting Technologies

Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Global Lighting Technologies(4935:TW) is a manufacturer of light guide plates, profitable for 14 consecutive years, paying dividends 12 years straight. Because of its B2B nature and declining 2023 numbers, stock price cratered to a level which I believe offers plenty of protection.

Trading is available on Interactive Brokers and English filings are available.

-Capitalization

Share price: NTD $50.1

Shares outstanding: 128.864M

Market cap: NTD $6,456M

Enterprise value: NTD $2,116M

Average daily trading volume: NTD $3M

-Key operating numbers

-What is a light guide plate?

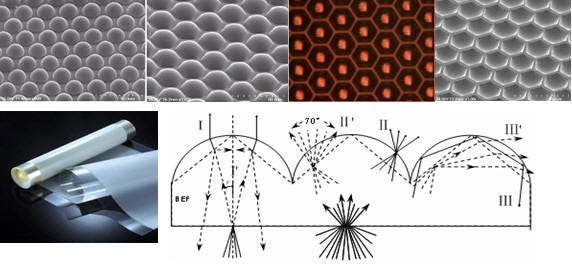

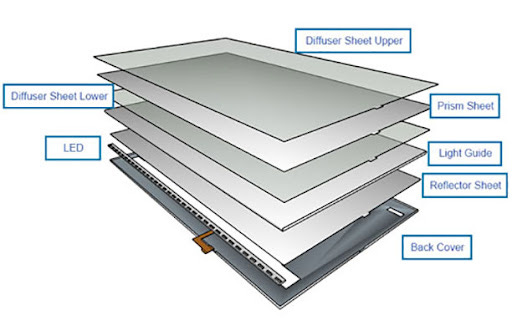

It is a component of a backlight module. In LCDs(liquid crystal display) the crystals by themselves do not emit light. There needs to be a lighting source. Light guide plates are plastic plates with microlens structure that guide the lighting source and achieve the brightness and uniformity of light and the display can be lit properly. GLT's plates are used in ebook readers, wearables, MacBook keyboards, Magic Keyboards, TVs...etc.

GLT deploys a hot extrusion process, which melts plastic particles(more specifically polymethyl methacrylate, PMMA) and extrudes microlens structure onto the plates. The plates vary in size, thickness, curvature, and are applied in credit cards(where the logo flashes in a 0.1 square inch space) to 82" TV. The founder and current chairman Mr. Lee used to be a chemist worked for Taita Chemical where he introduced cubic printing to Taiwan, from there he learned the ins and outs of hot extrusion process.

Plates need to have certain thickness and a good uniformity so the light can be bounced efficiently. Too thick the form factor can be compromised. Bad uniformity will require more light source, which compromises battery life in the end product.

-Threat of OLED

OLED stands for organic light-emitting diode. The name tells you it can light itself thus no longer needs a backlight module. It results in a better form factor and it is bendable/foldable.

However, OLED is much more expensive and not every application needs OLED. OLED has significantly shorter lifespan among other weaknesses. LCD will continuously have its place in consumer electronics.

-Strategic shareholder

Because of GLT's prowess in microlens structure, at a point Kodak, GE Capital, Warburg Pincus, Baring are their shareholders when microlens technology is in vogue. They have since all exited now, but there is one significant shareholder remaining. Wistron(3231:TW) owns 16.23% of GLT. The founder, his spouse, and his investment firm together own 25.75%.

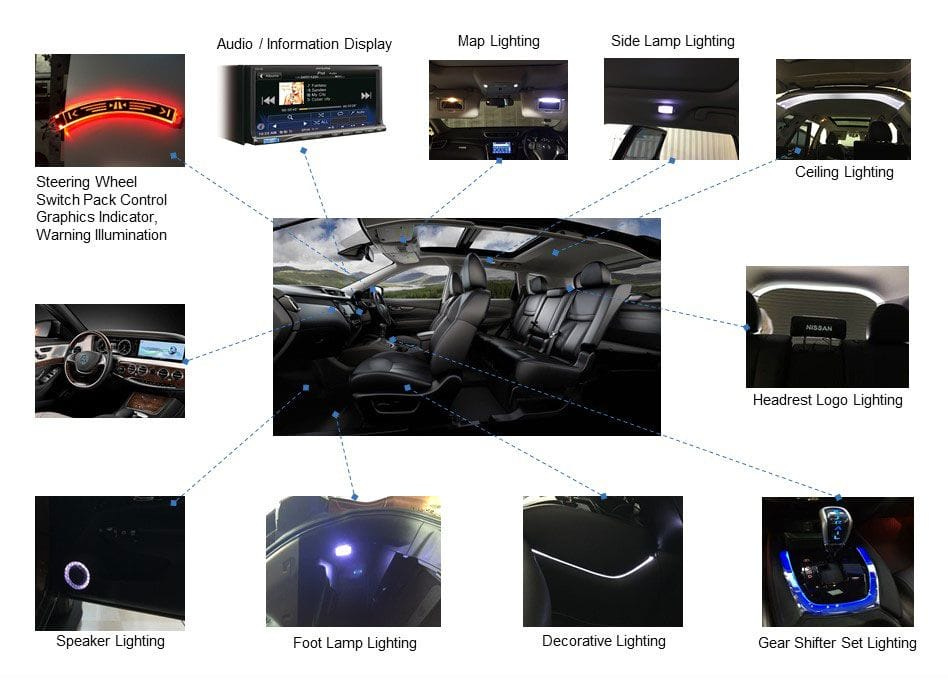

Wistron is an ODM/OEM with >70% of revenue in manufacturing notebooks and servers. There is some overlap in notebooks(36% of Wistron's business) and display(6%). ODM/OEMs in recent years have an ambition to add automotives exposure to improve margins, and GLT has some automotive applications which should complement Wistron handily. One can also reasonably assume Wistron helps GLT in terms of purchasing/sourcing/distribution...etc.

-Product mix

Revenue by products is:

-IT 64%. Includes MacBook keyboards, Magic Keyboards.

-Consumer 17%. Includes ebook readers, automotive lighting, indoor lighting.

-Wearables 14%. Includes products from:Garmin, Fitbit, TomTom.

Apple is the biggest account, made up 38% of total revenue in 2022. For competitive reasons there is no further detailed breakdown of product mix.

-Wide swings in operation

Massive fluctuations in operating numbers are mainly due to two reasons:

1. Butterfly Keyboards vs. Scissor Switch Keyboards

From 2016~2019 Apple employed butterfly keyboards where each key has a self luminating stainless steel dome switch. This design got rid of light guide plates. Yet even though butterfly keyboards are supposed to distribute pressure from fingertips more evenly and users can type faster and more accurately, they have many flaws. They are 250~350% more expensive than scissor switch keyboards(where light guide plates are required). The design allows dust to infiltrate and cause malfunctions. In 2020 Apple ditched Butterfly completely and brought business back to GLT.

2. PMMA price

Plates are made of PMMA particles, GLT is a price taker. When PMMA price dropped in 2019~2020 GLT's margin improved. There was some talk few years ago that they can use PS(Polystyrene) at least in some applications but PMMA and PS have the same mother, MMA(methyl methacrylate). I guess whatever maneuvering or design change there is always some raw material pricing risk.

The market blindly extrapolated GLT’s 2020 exceptional performance thinking it would last, however everything has cycles and MacBook shipment is expected to decline 30% which hurts GLT’s 2023 results. What is the normal earning power it is probably hard to tell, but in 2014~2022 the average earning before tax is $NTD 824M. Against an enterprise value of $2,116M that is a very attractive valuation.

-Dividends

One interesting nugget here is GLT is incorporated in the Cayman Islands. That means there is zero withholding tax on the dividends and it brings extra value for non-Taiwan residents as their withholding tax is 21%. Top two shareholders owns ~42% of the shares and their interests are aligned with a good dividend payout policy.

-Conclusion

Despite some headwinds, GLT is a resilient company that consistently produces healthy dividends. The valuation is ridiculously cheap. It probably cannot beat S&P 500 but I am owning it to beat my funding cost(2~3%). A balanced portfolio made up with companies like GLT is likely to achieve this goal. Lastly there is a growth opportunity in interior lighting for cars, where OLED lacks the stability, life, and cost-benefit.

Looked at it years ago together with some Taiwanese names. Deemed it interesting then. Thanks for bringing back up.