Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Taiwan PCB Techvest is the world’s largest LCD printed circuit board(PCB) manufacturer. Printed circuit board is a USD 80B sector with a CAGR of 3.82% that is an integral part of the electronics industry. The company has been profitable for 21 consecutive years and paying dividends 20 years straight. Trading is available on Interactive Brokers and English filings are available.

-Capitalization

Share price at 2024/5/13: NTD $40.35

Shares outstanding: 271M

Market cap: NTD $10,940M

Enterprise value: NTD $7,176M

Average daily trading volume: NTD $46M

-Key operating numbers

-Comp

-What is a printed circuit board

Taiwan’s PCB industry started in 1969 when a US company Ampex built a factory in Taoyuan. At that time Taiwan had lower labor costs, lax labor rights and environmental awareness. Through advancement in technology and evolution in consumer electronics, PCB throughout the years came up with innovations to conform with various form factors and performance requirements. The edge is no longer purely because of low environmental costs. Now Taiwan(and their subsidiaries in Mainland China) is number one in PCB manufacturing, five out of top ten PCB firms are Taiwanese companies.

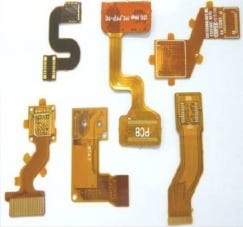

Types of PCB:

The sea change that drives the enormous growth of PCB I believe is personal computers in the 90s and iPhone 2 in 2008. In terms of R&D Taiwanese firms are at the forefront. As PCB is a must-have component in every electronic device and given Taiwan’s position in semiconductors, the PCB industry will continue to have a strong footing in the foreseeable future. Prominent PCB manufacturers include Compeq(2313.TW), Tripod(3044.TW), Zhen Ding Tech(4958.TW).

A printed circuit board(PCB) or printed wiring board(PWB) is a board that carries and connects components through its circuit layout. Normally there are several layers (each layer is made of copper clad laminate) in a board as different layers serve different purposes: grounding, power, signal…etc. Small holes(vias) are made to facilitate interconnections between layers.

Do not let the above picture intimidate you. The end goal is to print the circuit onto the board, thus the process is a lot similar to film developing:

-The copper is etched to produce circuit layout.

-Plating and soldermasking are applied to provide insulation/protection to each layer.

-Vias are drilled and plated to make interconnections between the layers.

AOI(stands for automated optical inspection) and testing are for quality control.

The manufacturing process is laborious and has a low margin. Etching and plating use highly corrosive and flammable chemicals, therefore transportation and storage need extra caution; emission, waste treatment, and recycling are closely monitored to ensure the process is operated in compliance with the environmental and labor safety codes.

If investors are looking for a higher value added part of the PCB supply chain I would suggest focusing on manufacturers of drill bits, solvents, resist ink as they are less exposed to the risks. They are high quality consumables, thus one can reasonably assume a predictable buying pattern and more stability. In the case of solvents there is NIMBYism, making it hard for new players to enter the competition, which benefits incumbent firms.

-Company history

Taiwan PCB Techvest was founded in 1998 by HCG(1810.TW), Chih Lien Industrial(2024.TW), and a venture capital firm H&Q Asia Pacific. HCG specializes in bathroom products and Chih Lien is in the steel wire/bar business. They diversified just for the sake of it. In hindsight this is probably less than ideal. For example, the aforementioned Compeq was founded by ex-Ampex engineers. Compeq was able to build on its strong foundations and was awarded iPhone 2’s PCB orders in 2008, catching the enormous growth of PCB. Perhaps Techvest should have more industry veterans initially.

Techvest was off to a bumpy start. Starting by making PCB for notebooks, the factory did not have an ideal arrangement for the assembly lines and the company ran into problems with equipment. The Asian financial crisis was not helping either. From 1998~2001 Techvest was losing money. They did have some break in receiving LCD and mobile orders in 2000~2001 as a secondary source supplier. Then they felt they were sub-scale for notebooks, so they pivoted into LCD in 2003.

Because of the difficulties Techvest was facing then CEO(current chairman) Mr. Zheng-Ming Xu took drastic measures to right the ship. Mr. Xu was in the military for over 10 years and has management experience in Compeq and HannStar Board(5469.TW). From a Business Today article released on 2008/07/17, he has an in-your-face, type-A, aggressive personality and ruled the company with an iron fist. He once fired a sales representative when that rep failed to win a big order from Innolux. He scolded and shamed foremen when defective products came out. Mr. Xu’s behavior appears harsh but it is somewhat common in electronic manufacturing. Foxconn and TSMC were not all about work-life balance either. PCB companies often operate with a demanding schedule, a small delay could result in not making the back-to-school or whatever seasonal window and risking the whole year’s profit.

It is an industry where every bit of efficiency gain needs to be captured. Companies squeeze out profits by streamlining the production lines, improve on yield, minimize downtime, reduce yield loss…so on. They also need to work in tandem with OEM firms, respond to their calls. Not to absolve abusive behaviors but this is why Mr. Xu runs a tight ship.

Also as mentioned before, the production involves the use of highly corrosive and inflammable chemicals, safety is top priority. From time to time catastrophic fire accidents occurred in PCB factories. Memorable one included Chin Poon’s(2355.TW) accident back in 2018. That fire lasted over 40 hours and claimed eight souls, truly heartbreaking. Likely due to Techvest’s tight management, fire accidents are limited, with only two minor incidents occurred in 2008, two in 2016 and zero casualty.

-Product Mix

The product mix is 50% PCB for TFT LCD and 30% for notebooks. Their customers for display include Samsung, AU Optic, Innolux, LG, BOE. Customers for notebooks include Quanta, Compal, Pegatron, Dell. In 2022 the largest customer was Dell, contributing 11.56% of revenue. Second largest is Quanta at 10.72%.

According to a market research report by Global Information on TFT LCD Panel, the panel market’s CAGR from 2024 to 2032 is 4.1%. Though lacking the excitement and form-factor of OLED, LCD has the benefit of offering exceptional cost-performance, as most of manufacturers’ machinery are fully depreciated. I expect LCD will continue to have a place in consumer electronics, as I mentioned in my 4935.TW write-up.

-Significant shareholders

This is potentially interesting. Board of directors(11.77%), institutional investors(8.75%), management(0.84%) all together own 21.36%. This is not a high number.

One founder is still on the board but it only owns 2.69%. The chairman Mr. Xu and his two sons are on the board too but together they only own 7.05%. Mr. Xu is 71 years old. It appears that the path of getting bought out could be possible. M&A is common in PCB as synergies can be achieved with a bigger scale, such as purchasing. Techvest’s near NTD $20B revenue is significant, Zhen Ding Tech(4958.TW) is the world’s largest player in this space, yet Techvest’s revenue is 12.5% of Zhen Ding’s. Out of 53 listed PCB firms in Taiwan Techvest’s revenue ranked number 13.

-Capital allocation

This is the part where the company can improve. The company currently has NTD $37.6B in net cash. However, that is made up of $109B in cash and $71.6B of debt. That is wasting money on interest expense.

Techvest is generally shareholder friendly. From 2014 to 2023 shares outstanding remain at 271 million, so at least shareholder interest is not diluted. Payout ratio is a decent 50.1% over ten years. One thing to note, in 2019 and 2021 Techvest sold their factories and had one-time gains, the company increased payout ratio in both years. It appears that they are at least reasonably shareholder friendly.

-Annual Reports

I feel like this is a great opportunity to show you how to use TWSE’s website to read the filings. Techvest’s website is too amateurish. Go to https://emops.twse.com.tw/server-java/t58query . The sixth button from the left is “Electronic Books“, when your mouse hover over that you can click “Shareholders’ meetings“. Enter 8213 and the year to read the annual reports.

-Conclusion

With an EV/EBT under four, there is tremendous value here. It has a robust history of profitability and treating the shareholders fair. Liquidity is healthy too. A portfolio of such companies should provide good performance over time.

Thank you for the write-up, very insightful! My understanding is that alot of PCB manufacturers are currently struggling due to over capacity, low PCB prices, and low demand. Have you heard this aswell? and when do you see a potential recovery in PCB prices/demand for PCBs? You suggest that further up the supply chain there could be some interesting companies in the "drill bits, solvents, resist ink" space - do you have any examples of publicly traded companies operating here? Also lastly how do you view PCB traders such as NCAB and ICAPE? (they operate in the low volume space) are OEMs struggling to access PCB manufacturers in the low volume space/has this been changing? and have you noticed whether the PCB manufacturing industry consolidating or not?

Thanks again and looking forward to hearing from you :)