Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

6807 FY Group is a couch ODM with IKEA as its largest customer(over 80% of sales in 2022). It was listed in April 2022. It is now trading at an EV/EBIT of 3.71 with a dividend yield of 6.28%, near an all time high. Right off the bat there are plenty of signs people do not like: a manufacturer, a concentrated customer with strong bargaining power, newly listed, trading at all time high. However, it is profitable six years in a row, has a healthy balance sheet, and I believe there is an effective catalyst that is working in favor of the company. FY Group is tradable on interactive brokers and English filings are available.

Capitalization

Share price at 2024/04/01: $41.4

Shares outstanding: 54M

Market cap: TWD $2,236M

Enterprise value: TWD $ 1,106M

Average daily trading volume: TWD $4.9M

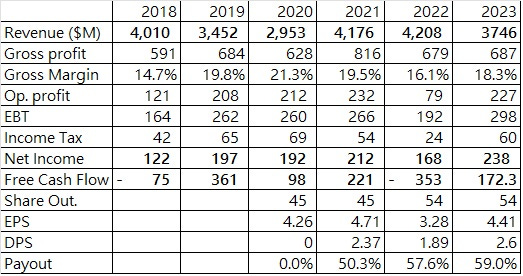

Key operating numbers

The catalyst

One of my favorite company disclosures in the Taiwan market is the number of shareholders. This number is updated weekly. From 9/22 to 3/22 the number of shareholders dropped from 1,515 to 1,298, a 14% decline. It is a positive sign, as it normally means two things: 1. Retail investors gave up and there will be less selling pressure going forward 2. Shrewd investors quietly collect shares from disinterested holders. Either development is positive. Coupled with the fact FY Group has a solid record so far I think it is worth some attention.

Company background

Located in Jiaxing, Zhejiang Province, FY Group specializes in couch ODM. Jiaxing is about 150 km away from Anji County, which is China's biggest manufacturing base for desk chairs. There are common parts between desk chairs and couches hence FY Group enjoys a cluster effect: access to skilled workers and is able to purchase metal parts(coils, springs, hinges ...etc) and timbers at low cost.

The company started to work with IKEA in 1997 and has built a trusted relationship with it. Even though IKEA's products are often ridiculed for their quality, this is not the case with couches.

For example, FY Group has produced two IKEA product lines: Friheten and Ektorp. If you click on "EKTORP, 3-seat sofa with chaise longue, hallarp grey, 252x88x88 cm" it has some stringent specifications:

-The cover is removable and can be machine washed.

-The cover can resist abrasion and has been tested to handle 15,000 cycles.

-10 year guarantee.

To achieve such a performance requirement is not easy. IKEA also emphasizes heavily on ESG, it has high standards on labor benefits, working environment, emission restriction, VOC requirements...etc. A couch is made up of coils, springs, webbing, padding, a frame, covering, and lots of man hours for upholstery crafts. To comply with the ESG standards is hard. FY Group's employees can only work 60 hours a week yet other companies can ask their workers to do 90 hours. Constant scrutiny from IKEA is a burden but at the same time after many years of compliance FY Group now has good structures and ethical practices. It is in a better shape to take orders from other reputable multinational companies. Recent years they have started working with Nitori, Costco, William-Sonoma. For example, they have only had Costco as a direct account since 2020, before that they conducted business through an agent. If they continue with robust operation more orders are going to come.

Competitive advantage

This is not a company with a strong moat. However there are some unique capabilities that are worth noting.

A long-term supplier-customer relationship is valuable and people often overlook it. Suppliers can improve design, reduce cost, improve quality, and shorten the lead time. This requires a deep integration between two companies. The customer no longer sees the supplier as someone to take advantage from. Currently FY Group provides more than 50% of IKEA stores in Asia, and the lead time is 30 days. FY Group is able to deliver to each IKEA store to lessen its logistic pressure. Perhaps not a moat but it is an important quality nevertheless.

FY Group employs a team of 100 people working on R&D of sofa foam. One goal is to improve the comfort of the cushion, another goal is to reduce the size so they can place more couches in a container and stretch out the shipping cost. Small initiatives like that help the company squeeze out extra profits.

Competition

FY Group has two main competitors. Henglin(603661:SHA) and UE Furniture(603600:SHA) . Both are based in the aforementioned Anji County and both have IKEA as its customer.

Henglin is a little bit all over the place. In 2022 37.7% of revenue is desk chairs, 24.6% in panel-type furniture, 13.1% in office furniture. Only 15.5% is couches. And 43% of total revenue is from its own brand so it’s interest go directly against its ODM customers. I do not think Henglin is a big threat in terms of couch ODM. In 2022 it acquired a SPC flooring company, making couch ODM further less of a focus.

UE Furniture competes more directly with FY Group. In 2022 68.8% of revenue is in desk chairs and 20.3% is in couches. Its couch business segment shows it has a lower margin as well as a lower revenue than FY Group.

According to the Centre for Industrial Studies the upholstered furniture consumption in 2021 is $USD 8.1B. There is room for all three players to grow. FY Group appears to be in a decent position and reaping the benefit of being close to Henglin and UE Furniture, enjoying the cluster effect.

Conclusion

This is a simple idea with a good catalyst. A cheap valuation: EV/EBIT of 3.71 with a dividend yield of 6.28% and the catalyst seems likely to move things faster. It is a one foot hurdle that is worth a look.

The low valuation is probably related to the high country risk associated with Taiwan, given its tensions with China. I see no reason why this risk should come down. So the valuation could probably stay depressed for quite a long time.

Are there any plans to use the considerable balance sheet strength (implied from EV < Market cap)?