Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Infinity Development 640:HK is a footwear adhesive manufacturer established in 1990. The adhesive industry, with proper management, offers companies a long runway for success. Since its listing in 2010, Infinity Development has demonstrated consistent earning power. This quality is often overlooked in Hong Kong, presenting an opportunity to own an extremely defensive company at a bargain price of EV/EBIT less than 2.

- Capitalization

Share price at 2024/10/4 : $HKD 0.75

Shares outstanding: 563M

Market cap: HKD 423M

Enterprise value: HKD 110M

Average daily trading volume: HKD 80K

- Key Operating Numbers

- Footwear adhesive overview

Adhesives and closely related sealants are frequently used and versatile products. Adhesives are used for bonding parts and sealants are for blocking passage of fluids or gases. In a way sealants can be thought of as weaker forms of adhesives. Adhesives have widespread applications, from large objects like floor and tiles to delicate components in precision manufacturing. Sealants are common in HVAC, home improvement, plumbing, roofing but these two have overlaps and large scale conglomerates like Sika offer extensive product lines in both fields. M&A are frequent in this space due to synergies in purchasing, distribution channels, productions, R&D. There is always room to innovate to address specific needs.

Footwear is one of the niche segments. The market size for footwear is $USD 489B with a cagr of 2.21% between 2024 and 2029 .

The development of footwear adhesive began around post WWII, when the manufacturing of leather shoes started to adopt glue to reduce the amount of hand sewing and stitching. Footwear adhesive has grown alongside footwear and it has a long history. There are two prestigious footwear adhesive manufacturers, Nan Pao Resins Chemical(4766:TW) and Great Eastern Resins (1775 but not publicly traded), founded in 1963 and 1955 respectively. It demonstrates that with prudent management, the staying power is resilient in this industry.

Infinity Development has been profitable every year since 2007, aside from the year 2017 when they recognized a massive asset impairment. It has paid dividends every year from 2011. Such consistency is rare, especially in the Hong Kong market.

-The engineering of footwear

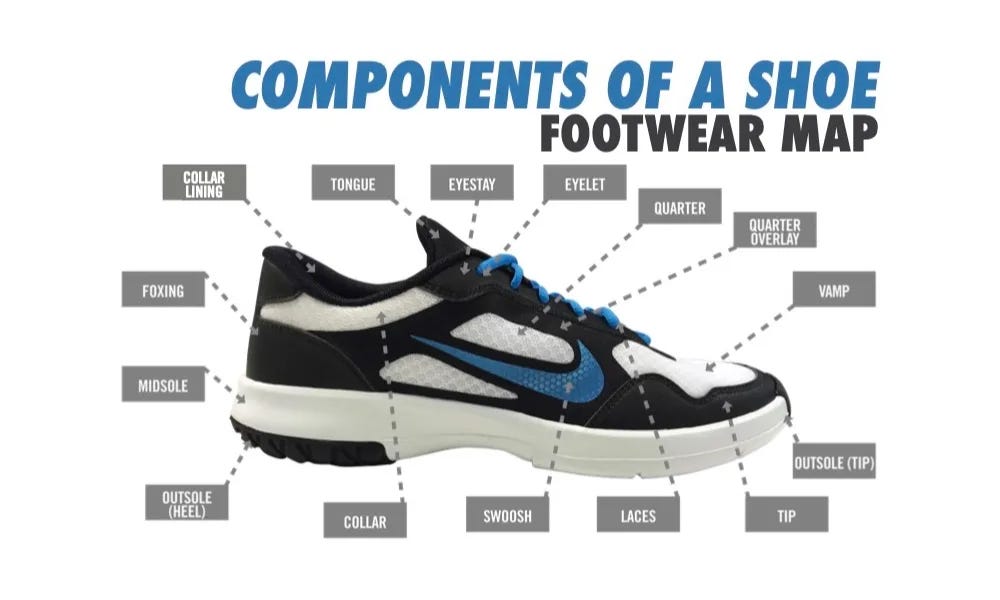

Footwear design is complex, with numerous parts serving specific functions. For example, a running shoe typically has 20 different components:

The midsole absorbs shock and provides bounce. The outsole creates a strong grip on outer surfaces. At the heel, the heel counter maintains the shoe’s structure, the foxing stablizes and supports the heel, the collar lining cushions the heel and ankle. On top the tongue and the quarter cover and protect the foot.

Quality shoes must be breathable, flexible, lightweight, strong, durable, ergonomic, and comfortable. Each sport has unique requirements, emphasizing factors such as shock absorption, ankle protection, air permeability, and slip resistance. Aesthetic considerations also play a role, highlighting the numerous specifications involved in shoe design.

Various components—including the outsole, foxing, collar lining, collar foam, and strobel—all require adhesives. These adhesives are crucial to shoe performance, needing to withstand a range of movements like running, sprinting, tackling, jumping, sliding, and shuffling. Simultaneously, they must maintain air permeability and possess good washing fastness, as well as some degree of color fastness and lightfastness to preserve the shoe's appearance and integrity when exposed to sunlight. For specialized footwear like trekking or climbing shoes, adhesives must also endure challenging environmental conditions. The quality requirements are stringent, as subpar adhesives can easily compromise the product's integrity.

One major customer of Infinity Development is Yue Yuen/ Pou Chen. Yue Yuen manufactures for Nike, Crocs, Adidas, Reebok, Asics, New Balance, Puma, Timberland and Rockport. Major brands conduct stringent quality control and performance tests. The combination of adhesive/primer/hardener used in manufacturing of a shoe model needs to be custom made. All together Infinity Development has 30+ years of working relationship with Pou Chen, its Taichung office is 700 meters from Pou Chen’s headquarters, demonstrating the stickiness(ahem) of its business.

There is no one-size-fits-all super glue. For example many people have experience with the outsole falling off their running shoes and normally they would try to stick it back with Super Glue. That is not going to work. Super Glue is too rigid, it requires a glue that is pliable and can accommodate foot movements. Secondly the outsole and midsole are made of different material, a primer probably needs to be applied first then the glue. Both surfaces must be clean and dry before applying primer or glue. Infinity Development has a diverse product line for the gluing of different parts of shoes.

-The requirement of footwear adhesive:

An optimal adhesive needs to accomplish the following goals:

Material compatibility

Depends on functionalities, shoes, for instance midsoles are made of varying materials such as evathene(EVA), thermoplastic polyurethane (TPU), thermoplastic polyeher ester elastomer(TPEE), polyether block amide(PEBA)...etc. For example, PEBA is excellent in providing strong bounce and lightweightness, but it is expensive. EVA is cheap but both bounce and lightweightness are not the best. Each material has different properties thus adhesive needs to be compatible accordingly. Surface treatment may also be required, primer is used to make the substrates more bondable, and hardeners are for curing of the glue.

Water and Heat Resistance

Adhesives must withstand various environmental conditions, including heat, cold, humidity, and moisture.

Enviromental friendiness

Volatile Organic Compounds(VOCs) are harmful to assembly line workers and are a source of air pollutants. Reduction of VOCs is a key focus of major brands.

Tack

The bond has to be strong when adhesives are initially applied and after full curing.

Each shoe uses a combination of adhesives. A footwear ODM typically carries multiple brands and multiple product lines. Adhesive in nature is a high-mix low-volume operation. In purchasing, HMLV raw material is always a headache because you need to run extensive quality controls and negotiate terms with many suppliers. A single source supplier solves many problems. Also as mentioned before, adhesive needs to be custom made and approved by the brands. It is not a decision that an ODM can make independently. Switching suppliers is a difficult process.

More importantly, adhesive behavior is particularly environment dependent. Temperature, air quality, humidity all have effects on how adhesives function. Adhesive suppliers need to provide timely technical support and troubleshooting to ODMs. The significance of this capability escalates as footwear ODMs in recent years set up factories in countries such as Cambodia, Thailand, Indonesia, Bangladesh, India, Vietnam because brands demand manufacturing diversification, or ODMs taking advantage of favorable labor cost and duty treatment. Production environment varies in each country. Additional complexity creates more problem-solving opportunities and makes Infinity Development more indispensable to ODMs.

According to the half-year report for 2024, the company generates only 15% of its revenue from China. This marks a significant shift from 2007, when 72% of revenue came from that market. Currently, 61% of the company’s revenue is derived from Vietnam, with 13% from Indonesia and 11% from Bangladesh. One way to invest in Hong Kong is to select companies with little China exposure and Infinity fits the bill.

-Footwear adhesives vs textile auxiliaries

From my previous post, it is clear that footwear adhesives share similarities with textile auxiliaries: both consist of a range of mission-critical products that require extensive trial and error, attentive after-sales service, and expert knowledge on materials. When issues arise, entire batches of merchandise can be rendered unusable. I believe both Big Sunshine and Infinity Development possess solid competitive advantages in their respective industries. While Infinity Development boasts a longer track record, Big Sunshine lists on a more efficient stock market(i.e. not Hong Kong).

The Hong Kong market shows limited interest in niche industrials, making it an unsuitable environment for listing. A more fitting market might be Taiwan, where Taiwanese footwear ODMs dominate. Additionally, Hong Kong is filled with value traps, which further depresses the valuation of Infinity Development.

-Growth

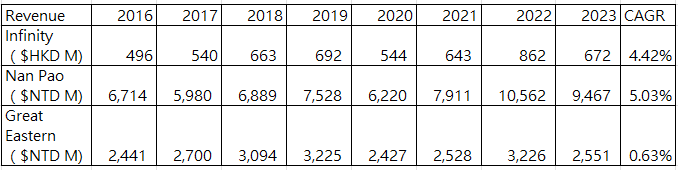

Here is a chart of Infinity Development’s revenue vs main competitors Nan Pao and Great Eastern Resins’ footwear adhesive revenue:

It appears that Infinity and Nan Pao are steadily capturing share from Great Eastern, and Infinity achieving consistent growth and notable improvements in its bottom line over the years. Notably, while both companies began by specializing in footwear adhesives, they have since diversified to the point where footwear now accounts for less than half of their revenue.

-Company history

Infinity Development was founded in 1990 by Mr. Ieong Un in Macau. Prior to establishing Infinity, Mr. Ieong spent six years working for a local company that distributed petroleum-related products. In 1993, Infinity Development acquired the rights to distribute hardeners—curing agents essential for adhesives—from Huntsman, coinciding with the boom in footwear manufacturing in the Pearl River Delta during the early 90s. In 2002 and 2005, Infinity signed a collaboration agreement with No-Tape, a footwear adhesive manufacturer based in Osaka, Japan, for No-Tape’s expertise in formulas and technical support.

-Risk

Infinity’s largest customer, Pou Chen, holds 15.5% of Nan Pao Resin 4766.TW, which is also Infinity’s main competitor. At first glance, this appears to be a significant threat. However, ODMs typically maintain relationships with at least two adhesive suppliers to mitigate risk. This creates space for Infinity, especially since Great Eastern Resins seems to be under more pressure to lose market share. Additionally, brands possess the power to switch adhesives, rather than ODMs. Even if ODMs wanted to switch suppliers, the process can be cumbersome and unnecessary as long as Infinity continues to deliver quality products.

In 2015, Infinity frustrated many investors by issuing 50 million shares at HKD $1.6 to diversify away from its core business. Their intention was to start an energy saving business with Sinochem Beijing. Diversification into unrelated areas often raises red flags. Not trying to exonerate management, it is important to note that market sentiment in Hong Kong in 2015 was vastly different from today. Back then, management may have felt pressure to present an exciting narrative and show investors that they had a second leg for growth. Although this reflects poor capital allocation, I do not believe it was driven by fraud or deceit.

In recent years, the company has paid dividends with a heathy payout ratio, coupled with the fact $73.8M were spent in buybacks between 2016 to 2020. This indicates a shareholder-friendly approach, at least from 2016 onwards.

Another point to consider is that Mr. Ieong Un is now 70 years old and holds 74.79% of the company. This raises concerns about a potential low-ball privatization offer, given Infinity’s depressed valuation. However, in Hong Kong, only 10% of disinterested shareholders are needed to veto a privatization offer. What it means is that it requires only 10% * (100%-74.79%) = 2.52% of shareholding. This is a low bar and provides a decent defense.

Conclusion

Investing in Hong Kong presents challenges. Personally, I have adjusted my expectations to target a 10+% annual return. Infinity’s dividend yield alone(~10.3%) exceeds that, and the company operates a mission-critical, defensive business that the market is unaware of. With an EV/EBIT ratio below 2, I believe the downside is limited.

Nice Find.

While this stock has no near term catalyst, its gross profit margins have been increasing at each half year reporting (37.5% for 1H FY 2024)

In its recent half year reporting it has been able to record higher gross margins on the back of a higher revenue as well.

Adding to that

Nan Pao has shown growth of around 12% from (Apr 24 - Sept 24 vs Apr 23 - Sept 23)

Greco has shown growth of around 17% as well

Yue Yuen's Manufacturing business went from -0.10% YTD Change in March 2024 to 9% YTD Change in September 2024

The above might indicate that the fall in revenue is likely to stop this upcoming half year and might even show revenue gain(Though i feel that overall revenue compared to Last FY should be within the range of -10 to +10% due to 1H Revenue being lower YOY)

If the company is able to execute similar 1H Margins or better, it would likely result in a higher net profit. With the company being a keen dividends payer, this would translate to better yield

The interesting mid-term will be whether margins can improve further with the new factory. 74 million already put in and the ppe+rights use of asset as of March 2024 is only 121 million. As such, it definitely is quite a huge capex / project.

Dont like that they dont comment on declining revenue, since last year no word on why. Also what they plan with the new plant in Indonesia without demand is not clear. Their communication is poor, I guess that may be one reason why they look undervalued.