6192:TW a distributor of process control components benefiting from big infrastructure spend

Lumax International

Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Lumax is a distributor of process control components with esteemed clientele and long operating history. It is profitable for 25 consecutive years and paying dividends 22 years straight. In recent years the company enjoys improving margins and bottom line. There is an ongoing gigantic overhaul on the nation’s electrical grid and Lumax is set to benefit from it. Investors receive this optionality without paying extra. Its stable earning power and current valuation should provide a high floor. English filings are available and the stock is tradable on Interactive Brokers.

-Capitalization

Share price at 2024/2/21: 92.5

Shares outstanding: 96.16M

Market cap: NTD $8,894M

Enterprise value: NTD $5,488M

Average daily trading volume: NTD $10M

-Key operating numbers

-Company history

Lumax was founded in 1975 by four engineers who were classmates at National Cheng Kung University. They received their big break in 1987, a $USD 15 million process control project for Yongan LNG Terminal owned by CPC Corporation. Throughout the years Lumax customer base grew and now includes TSMC, Delta Electronics, Taiwan Power, Formosa Plastics Group. Chinese customers include CNPC and Sinopec.

-Distributor

Distributors have a wonderful business model. The value they created to suppliers include:

-Finding new customers

-Reducing credit risks and friction, managing payment

-Cutting lead time and managing inventory, warehouse, and logistics

-Identifying new needs and applications

-Being closer to end users, providing support, training, installation, and after-sale service Collecting feedback

-Sales and marketing strategies

Process control requires high-touch service, hence the role of a distributor is even more significant. Its service is integrated in end users’ routines, enabling opportunities of offering higher value-added service.

-What is process control

Process control refers to the regulation and control of industrial processes to ensure the system runs effectively, smoothly, and within specified parameters(emission control, energy efficiency…etc). It is perhaps better to use an example of a coal-fired station:

Burning coal creates thermal energy. It heats the boiler and produces steam. Steam then drives the stream turbine and creates work. This work generates electricity. A condenser is installed to cool down the stream to recycle back to the boiler.

During that process temperature, pressure, flow of the steam need to be monitored and controlled. This is where process control comes in. Similar processes occurred in refineries, chemical plants, waste/water treatment plants...etc as well. Gauges, meters, level controllers, switches and valves are in place to control steam and liquid and that is what Lumax is offering. Through time there are high end devices such as gas analyzers so emission can be recorded and reported to EPA in real time. Or like a monitoring system to detect abnormal vibrations from generators, pumps, and compressors. Lumax’s suppliers include Yarway/Emerson (level controllers), ASCO/Schneider(solenoid valves), Panametrics/Baker Hughes(ultrasonic flow meters), Pentair (valves) with Emerson being the largest supplier with 37% of net purchase.

Such equipment requires high-touch service like installation, testing, and training from Lumax. Customized softwares are built for data gathering and analyzing. For Emerson, GE, ABB, Honeywell to skip over Lumax to serve end users directly there will be a lot of hassles. They need to re-learn all of the end users’ setups, layout, overhaul/tune up/annual maintenance schedules and the intricacies issues like government purchase policies and procedures. End users will face disruptions and bear severe consequences. Switching costs are enormous. It is likely not worth it for the brands to do so.

-Why is this cheap

Given the nature of distributors and the fact they are distributing a fair bit of MRO consumables, the valuation is absurdly cheap. I believe there are three reasons:

Its awkward classification

In Taipei Exchange Lumax is listed under the subgroup “other electronics”. It is an awkward classification, analysts covering electronics and semiconductors all of sudden need to learn about grid and power infrastructure. A more appropriate subgroup should be “electric machinery” like Chung-Hsin Electric & Machinery (1513:TW) and Shihlin Electric (1503:TW).

40% revenue is in China

Lumax has Emerson’s distribution rights in North China(Beijing, Tianjin, Hebei, Shanxi and Inner Mongolia) and Northeast China(Liaoning, Jilin, and Heilongjiang). Though Lumax sells to state-owned enterprises, North China’s economy is mediocre and Northeast is the absolute worst. Northeast is known for corruption, bureaucracy and generally unfavorable to businesses. Considerable number of graduates and competent workers are fed up and move to other provinces for work. The market could be concerned about Lumax account receivables quality.

Massive blackout on 2017/8/15

On 2017/8/15 a massive blackout hit the northern half of Taiwan and affected 5.92 million households. Taiwan Power and Lumax pointed fingers at each other for the operator’s mistake. Taiwan Power ended up suspending Lumax from bidding for one year and sued them for $TWD 358M. The court then lowered the compensation for negligence to a mere $NTD 4.35M and Lumax paid it in the fourth quarter of 2021.

However the root of the problem is because of Taiwan’s outdated and fragile grid, Lumax was more likely a scapegoat. Since 2017 Taiwan Power had three other incidents of blackouts:

2021/5/13, affected 4.62M households

2021/5/17, affected 1M households

2022/3/3, affected 5.49M households

One thing to note, even during the 17-18 suspension Lumax still had decent numbers.

-Sizeable grid budget in near future

Vulnerable grid is certainly alarming. Current power infrastructure has a multitude of challenges and the government is setting many goals to fix that. As you might know already, advanced nodes in foundry using extreme ultraviolet lithography consumes a lot of electricity. The economy needs a larger power capacity. The government also wants to overhaul the grid to be smarter, more flexible and resilient to minimize blackouts. There is a global trend to reduce carbon emission and incorporate a larger portion of renewable energy, which Taiwan is mainly banking on wind. In a more short-term outlook there are some more achievable projects such as turning coal-fired/petrol-fired stations into natural gas-fired. They will still produce carbon footprints but at least the emission is lower. As a result Taiwan Power’s capex ballooned in the past few years and is expected to continue to grow in the near future:

Of course not all the budget will be spent on power generation, a meaningful portion is on transmission and distribution. The market has already reacted and Chung-Hsin Electric & Machinery (1513:TW) and Shihlin Electric (1503:TW) have good performance over past 3 years:

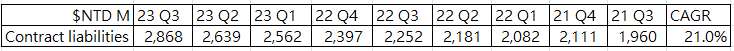

I believe Lumax will be a beneficiary too and its contract liabilities is showing that, with a CAGR of 21% in the past 8 quarters:

One thing to note contract liabilities is what customers paid in advance. The company has an obligation to fulfill these orders. So a big jump in contract liabilities is generally a good sign - signifies a strong bargaining power and healthy orders.

-Shareholder base

The founders are in their 70s and they are still on the board and in management. Age is a concern but keep in mind distributors have a robust business model and a reasonably competent management should be able to handle it. The daughter of one founder is in the management. Collectively the founders and their family own about 21% of the company. Fubon Life owns 6.47%. Two Fidelity funds(Small-mid Cap and Low-Priced Stock) own 7.01%. Virtus KAR Global Small Cap Fund owns 3.09%. The shareholder base is diverse with decent institute investor presence.

-Conclusion

The business model alone should be worth a higher multiple. Coupled with its net cash position, long profitable history and the prospect of earning big orders from Taiwan Power, current price appears to offer an excellent risk-reward. At worst the borrowing rate now is about 2.3~3% and the dividend yield seems to be able to cover it and more. If the company decides to do another return of capital this will also create extra return.

Interesting company. They repurchased 6.5% of their shares in 2023. Is this a common occurance & do you antcipate more buybacks? Thx.

This is such a wonderful company. Would be trading at 17x earnings or more in the US.