4536:TW an innovative Carbon Fiber Reinforced Polymers manufacturer with diverse product lines

Topkey

Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Topkey is an innovative Carbon Fiber Reinforced Polymers manufacturer with high margin and diverse product lines. Founded in 1980 the company was able to grow organically by consistently delivering high performance products over time. It is profitable for 15 consecutive years and is paying dividends 12 years straight. Trading is available on Interactive Brokers and English filings are available.

-Capitalization

Share price at 2024/2/15: NTD $182

Shares outstanding: 90.82M

Market cap: NTD $16,529M

Enterprise value: NTD $13,378M

Average daily trading volume: NTD $27M

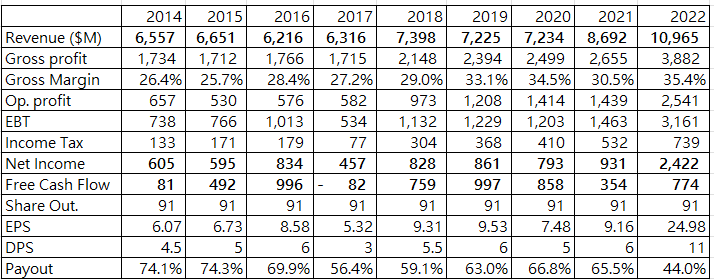

-Key operating numbers

-Company history

The main founder Mr. Shen used to work for a tennis racquet ODM/OEM company Kennex in the 1970s, where he learned the ins and outs of carbon fiber molding. Right after he left Kennex in 1979 his acquaintance from Dunlop Slazenger asked him to fulfill a sizable order of tennis racquets. Topkey was then founded with three other friends and Mr. Shen was able to win over Wilson in 1986 and Prince in 1988 for racquet ODM/OEM contracts. Product lines then were expanded into motorcycle/bicycle helmets in the 90s. Situated in Taichung allowed the company to be exposed to a well-developed bicycle industry. Topkey came up with a carbon fiber frame prototype in 1994 and subsequently set foot in manufacturing bicycle parts. In 1995 Topkey was able to acquire Northwestern Technology Plastics, a supplier of McDonnell Douglas, making an entry in aerospace and is now producing passenger seats for aircrafts.

-What is a CFRP?

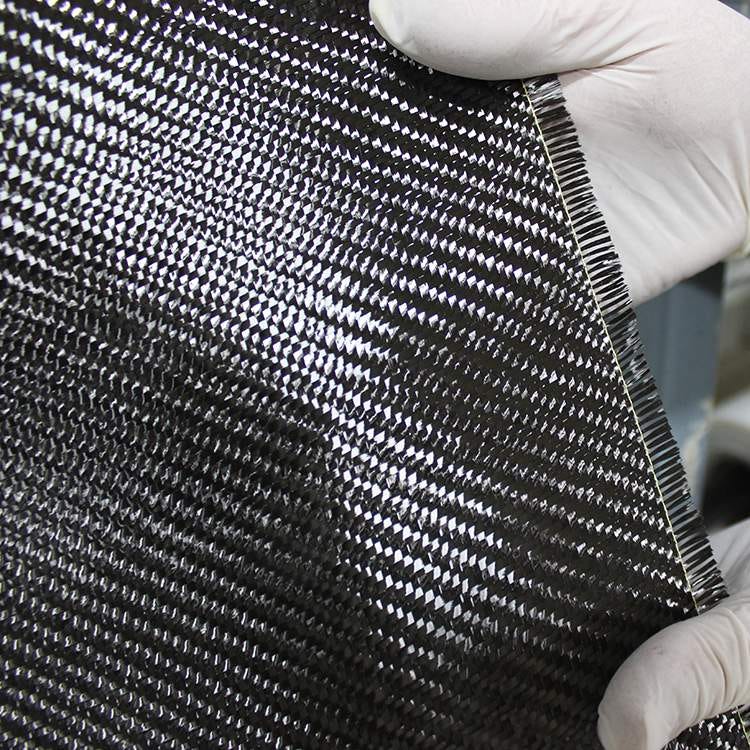

Carbon fiber reinforced polymers(CFRP) are lightweight, strong, rigid, can tolerate high temperature and corrosion, and have a long fatigue life, hence they have a variety of applications. It is made of carbon fiber and resin. The process of carbon fiber molding is as follows:

- fibers are only strong longwise, they need to be weaved with certain patterns into a sheet to be strong lengthwise too

- carbon fiber sheets are spreaded into a mold, resin is then filled/coated. This step is repeated for several layers.

- the mold is vacuum bagged to draw out air bubbles, then put it into an oven for curing.

- few more layers of resin are applied

- polished the surface for final touch

The process is time-consuming and labor intensive. Sheets need to fit the edge of the mold evenly and resin needs to be coated evenly. If the curvature is tricky it adds complexity. Some workpieces such as bicycle frames/forks/handles/chain wheels/sprockets/wheelsets required a steep learning curve. One bike typically requires over 200 parts, though not every part is made of carbon fiber, this still calls for a substantial number of molds. Mold building is time-consuming and expensive. For a competitor to jump in and start making CFRP parts it is prohibitively costly. Years of mold build-ups and process experience provides Topkey a healthy head start. Though one good news is that due to efficiency gain, the number of labor has steadily decreased. In 2013 the total number of workers was over 8,000, in 2023 that number is 6,361 yet the revenue is 50% higher.

-Resin, a trade secret

Each CFRP product has its own requirement, formulation for resin is key to achieve that specific performance. For example, a motorcycle helmet needs to be rigid but not too rigid so it can disperse the impact on the blow to the rider's head if he/she falls. Chemists tweak the formulation for the helmet to perform to its intended purpose. Ditto for other products. In 2006 Topkey worked with Babolat to develop the Cortex System. It is said to be able to filter out unwanted vibrations for a better feel/touch. Damped vibrations also reduce risks of arm and wrist injury. Enthusiasts are willing to pay up for a racquet with fine touch and faster speed or a more lightweight helmet.

The formulation process initially is full of trial and error. It is a trade secret that cannot be acquired easily. Working with other competent chemists/engineers, Mr. Shen was able to leverage his degree in Chemical Engineering at National Taipei University of Technology as well as his prior experience at Kennex to build design wins in the company's early years. One thing to note, the current president of the company is the daughter of Mr. Shen and has a bachelor degree in material science and a master degree in physics from Imperial College of London. They are serious in R&D commitment.

-Product mix and end market

Product mix is as follows:

1. Bicycle parts 54%, Specialized is the biggest customer, contributed to 22% of 2023 revenue. Other customers include Merida, Cannonale.

2. Helmets 18%. Customers included Mizuno, Sumitomo, AGV. Valentino Rossi’s helmets were manufactured by Topkey.

3. Racquets 12%. Customers included Wilson, Babolat, Prince. Rafael Nadal, Iga Swiatek, Daniil Medvedev are some of the users.

4. Medical & aerospace 7%. Customers included GE, Philips, Siemens, Toshiba, Spirit AeroSystems

-Bicycles and E-Bikes

Taiwan has had an advanced bicycle manufacturing industry started in the 1970s spearheaded by two titans, Giants (9921:TW) and Merida (9914:TW). Giants received OEM orders from Chicago-based Schwinn in 1977 and from that built a robust foundation in manufacturing as well as bicycle related technology. It is located in Taichung where CNC tooling and metalworking capability is mature. Bicycle making is mainly assembly, putting 200 parts in place. Due to its labor intensive nature and rising Taiwanese worker wages Schwinn in the late 80s started to move production to China, cut orders to Giants. This propelled Giants to build its own brand.

Giants was able to establish its own brand in the 80s and through time moved up to premium products such as BMX, mountain bikes, racing bikes(with a successful sponsor campaign on Team Once in 1998 Tour de France). Merida on other hand was able to secure OEM contracts from Specialized and acquired part ownership(currently holding 35% of Specialized), with product lines in BMX and racing bikes.

E-Bikes have had tremendous growth since 2015. Improved battery technology is one factor, but I. Mid-drive motors and II. Torque sensors are what I believe are crucial breakthroughs. Mid-drive motors place the motors in the bikes’ center of gravity, creating a more natural balance and efficient power transfer. Torque sensors allow the bike to detect how much effort a biker is exerting, if the rider is in a downhill the bike will not propel. Likewise in an uphill the bike will push hard on the pedals. That makes for a smooth riding experience. In terms of lifestyle E-Bikes make a lot of sense too. In Europe where streets are narrow with many turns E-Bikes are quite handy. Over the long run an E-Bike is probably more economic than public transportation for some commuters. Its range provides an option for non-bikers to enjoy the fun of biking. Various government subsidies don’t hurt either.

With premiumization of bicycles and E-bikes the Taiwan bicycle supply chain is able to benefit, which includes Topkey. Carbon fiber frames functionally are more lightweight while providing a strong structure. One thing to note Giants’ frames are supplied by its wholly-owned subsidiary Giantec, Topkey’s frames as well as forks/handles are sold to Merida.

According to PwC’s Global Bike & Bike Accessories Market report, premium bikes’ market size is around €51.5B, for E-bikes market size it is €23.7B. 21~25 CAGR for E-bikes is 6.8%, I have no specific number for premium bikes, but if we use all bikes as a generalization the CAGR is 5.3%. It appears that there is still a good amount of white space.

-Shareholder return

As mentioned before, molds are costly and carbon fiber molding takes a long time to master. Luckily Topkey is in a stage of reaping the fruits of their prior labor. They generate decent free cash-flows year after year and are currently paying dividends in 12 consecutive years. That is generous. Mr. Shen and his family own 19.27% of the company, two other co-founders and their families own 10.85%. Significant shareholders’ interests are well aligned with other shareholders.

-Risks

Cyclicalities of bicycles

Bicycles have a long lifespan and carbon fiber can last a lifetime if there is no damage. Thus there will be cycles with weak demand. In December 2022 Giants sent a notice to their suppliers to delay payments for 45 days. There was absolutely no need for Giants to do that as they are financially sound and had no problem accessing cheap funding. It sent shockwaves to the entire bicycle supply chain. Inventory overstock is something that can happen from time to time and investors need to be aware of that.

Thermosetting vs thermoplastics

Topkey’s products are thermosetting, which means they can only be downcycled or end up in landfill. On the other hand thermoplastic CFRP can be recycled but they are not rigid enough. There could be a scenario where ESG-aware investors cast Topkey in a negative light and stating Topkey is not being environmentally friendly.

-Conclusion

With a long history of delivering profits and dividends to shareholders, current valuation is not expensive. The liquidity is decent and should be accessible for many investors. Carbon fiber is an exciting field where engineers are constantly looking for new applications. End market is growing. In the past Topkey was able to use its expertise in making racquets and pivoted into more challenging applications. Hopefully they can do the same and keep pushing for higher value-added products.

Thanks for the write-up.

What drove the profit jump in 2022, and is that sustainable?