3022:TW Industrial PC Manufacturer with 36% Margin and 4.4% dividend yield trading for <5.5 EV/EBIT

IEI Integration Corp

Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

IEI Integration is a manufacturer in industrial PCs and related products(embedded systems, motherboards, controllers, network equipment...etc). Industrial PCs is a growing industry with robust scale and strong companies. Founded in 1997, IEI Integration has been profitable in 26 consecutive years. Paying dividend 21 years straight. Trading is available on Interactive Brokers and English filings are available.

-Capitalization

Share price at 2024/1/30: NTD $78.4

Shares outstanding: 176.598M

Market cap: NTD $13,845M

Enterprise value: NTD $7,678M

Average daily trading volume: NTD $20M

-Key operating numbers

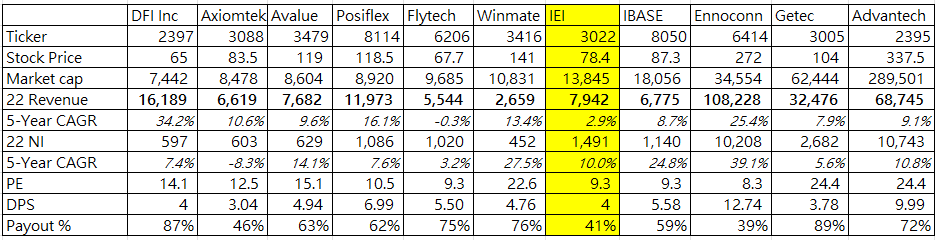

-Comp

-What is an industrial personal computer

An industrial personal computer is a custom made computer to be used in harsh environments and/or is dedicated for specialized tasks. Examples include rugged notebooks/tablets/panels, medical cart workstations, embedded computers. Industrial PCs typically have less computing power than PCs, but they are equipped with different functionalities, such as anti-shock, water-proof, dust-proof, able to withstand extreme environments, depending on the usage. Applications dictate the level of customization. Few common uses included production lines, defense, transportation, hospitals…etc.

Industrial PCs undertake rigorous testing and end customers' average order is a few hundred units. Production lines need to be switched after each lot. For comparison, NB shipment in a typical year is ~160 million. Hence PC ODM/OEM don't want to step in as it is hard to gain economies of scale. By going through production hassles industrial PCs have healthy margins.

High margin and fragmented application attracts competition as small firms can always target hard-to-reach places. It is not difficult to carve out a niche. There are about 30 listed IPC companies in Taiwan.

IPC market size is around $USD 5B with a CAGR of 5.5% between 2023~2028. The fact there are many firms build a robust cluster and in aggregate benefits the majority of firms in the supply chain.

-Company history

The founder Mr. Guo founded the company in 1997 at the age of 35, IEI integration was listed 4 years later and at that time was the second biggest IPC firm. In the early 90s, Mr. Guo was a distributor for industrial PCs and peripherals and thus was able to see the potential. He worked crazy hours(18 hours a day, 7 days a week) and traveled frequently all over the world for orders. He bet big on capex in the early years and that paid off. Years of hard work and continuous exploration the company has multiple strong product lines. He resigned in 2016 following an accounting scandal. Today the company annual turnover is $NTD 8B.

-Product Mix by Use

IEI's embedded systems, controllers, gateway, motherboards, panels...etc made presence in the following fields:

-Industrial(33% of revenue): includes Autonomous Mobile Robots, automations, Automated Optical Inspection machines.

-Medical(28%): includes endoscopy, EMR, anesthesia equipments

-ODM(23%): includes voting machines, gaming machines(at one point Gtech/International Game Technology is a customer), POS(ships to Partech, Subway & Jack in the Box are the end users)

-Network(11%): includes data centers, edge computing, servers/routers/firewalls

I feel like this is a healthy mix. The company has an affiliate QNAP(IEI owns 24.45% with QNAP in turns owns 13.57% of IEI, if cross-holding is something you loathe you can turn away now) offering NAS(Network Attached Storage). QNAP’s products complement IEI well and create cross-selling opportunities. Also storage creates a stickiness and puts IEI in a better position for future engagement.

-Big accounting scandal

From 2013 June to 2014 March IEI wrongly recognized gross revenue(correct accounting method is net revenue) of a subsidiary. Even though gross margin and operating margin stayed the same, the revenue was inflated. When the gross margin percentage is around 35% the market acted bullishly imagining this big jump is going to flow through the bottom line, and the stock price popped. When IEI eventually corrected them it faced huge backlash. Prosecutors conducted an investigation(but didn't press charges) and Mr. Guo was fed up. Perhaps he felt like he gave everything to the company yet a mistake undid all his efforts. He and CFO resigned in 2016.

-Shareholder return

That scandel left a bad taste in investors' mouths for sure. However before that and from that point on IEI Integration had paid dividends every single year. The payout ratio is OK. In 2018~2019 they did buybacks and return of capital total $ 1.5B, against a market cap of $12.9B at 12/31/2017. I am satisfied with their efforts. Mr. Guo and his relatives still have 34.85% of ownership. Their interests are aligned with other shareholders

-Covid and challenges for small firms

Covid presented a great tailwind for IEI Integration. As mentioned before there are many small industrial PC firms. It used to be the case that smaller players only needed to focus on one or two specialized fields then it is enough for survival. Then Covid came and subscale players endured a substantial blow. Chip and component shortage became a tough pill to swallow. Some products lacked one or two parts and shipment was delayed. That means build-ups in inventories and ate up working capital, added liquidity pressure. From a customer relationship point of view, not knowing the lead time is probably one of the worst things that you can tell your customers, especially industrial PCs that are known for quick delivery. There were other issues such as supply chain disruptions, labor shortage, inflation, high shipping cost, fight for container spaces...etc. It is not hard to see it is challenging for a subscale player to navigate in such a tough environment.

Because IPCs have specific use, distributors and system integrators are the ones pounding the pavement and visiting end users. They have a hands-on selling process and if they get the order they will install machines. Covid-imposed travel bans and lockouts stopped distributors from making sales. Thus for small firms who lack ground game it is hard to make a good impression in marketing.

This is when having scales help. Prescient firms like Advantech and IEI before Covid have made an effort in providing webinars, case studies, YouTube videos, product specs...etc. on their websites. Tech support and helplines are available. This allows less friction in end user engagement as well as building a positive corporate profile. When end users are stuck in lockdowns those resources serve as effective marketing material. When small firms try to replicate it is too late. As a result IEI did well in the Covid years and strengthened its competitive position.

Industrial PCs are deployed in critical, demanding, and sometimes sensitive operations, it is selling trust. With resourceful web content, it conveys a dependable impression and provides infrastructure when customers need help. IEI also claims to possess superior software and firmware to ensure quality user experience and system stability.

Troubleshoot and service are crucial too. For subscale firms it is hard for them to provide tech support 24-7 and fix the problems right away, further putting them in a disadvantage to compete.

-Industry dynamic and consolidation

Under the Covid backdrop both PC & IPC firms are open to collaborate with each other. IPC firms need help in securing sourcing and lower purchasing cost. For PC ODMs, as NB shipment plateaued, PC firms are keen to explore other applications. They have done an excellent job in pivoting to server ODM/OEM since 2012, as a server is just another form of computers. PC firms investing in IPC counterparts is a natural progression.

Secondly due to the fragmented nature of IPC there are consolidators such as DFI and Ennoconn. But in my opinion both companies went a little overboard and brought in some less-related, less-synergistic acquisitions that could be distractions in the future(not saying that they are destroying value but it probably takes time to realize there is some hair in their investments). Advantech appears to be a prudent and astute consolidator.

I do not anticipate a takeover of IEI but its comprehensive product lines and valuation should make it an attractive target.

-Conclusion

IEI Integration is solid, profitable company that occupies a niche. Solid shareholder returns. Daily volume should make it actionable for many investors. It appears that IEI at this price is safe and inexpensive. If the goal is to merely beat the cost of capital in Taiwan(2~3%) it can probably deliver.