Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Big Sunshine Co 1475:TW is a textile auxiliaries supplier that remains relatively unknown, even within the Taiwanese investing community. The textile auxiliaries industry is a $USD 8B market and is estimated to grow at a CAGE of 3.9%. I believe Big Sunshine is worth considering due to the following reasons: 1) Its ability to leverage resources from its affiliates, 2) Its mission-critical, recurring, and high-touch product offerings, and 3) The limited coverage it receives. Trading is available on Interactive Brokers and English filings are accessible.

-Capitalization

Share price at 2024/8/26: $NTD 61.1

Shares outstanding: 60.02M

Market cap: NTD 4,034M

Enterprise value: NTD 3,064M

Average daily trading volume: NTD 27.6M

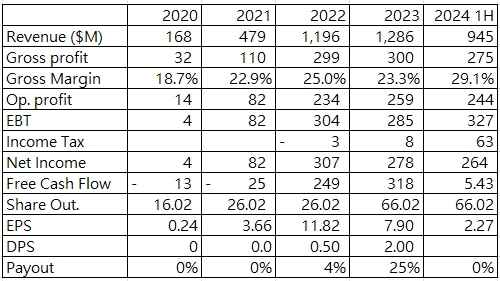

-Key operating numbers

-Taiwan's Textile Cluster: A High-Functionality Hub

Taiwan's textile sector boasts an output of approximately $100 billion USD in 2023. Traditionally, the textile industry has been known for its labor-intensive nature and environmental impact, leading to a trend of production shifting to countries with lower labor costs and less stringent regulations. Taiwan, however, presents a unique case.

Despite facing similar pressures, Taiwan has maintained a strong textile presence, largely due to the influential Formosa Group. This conglomerate produces upstream petrochemical raw materials, enabling local smart textile ODMs to experiment with innovative fibers and filaments. The result is a high functionality, high-value textile supply chain in Taiwan.

The quality and performance of these Taiwanese textiles have gained international recognition. A testament to this is the 2022 World Cup, where jerseys for teams such as Germany, Japan, Spain, Argentina, Mexico, Belgium and Wales were manufactured by Taiwanese ODMs, including Far Eastern New Century, SSFC, and Eclat. Imagine a jersey that weighs only 145g, is made from recycled materials, can quickly wick away perspiration, and withstand tackles and grapples from defenders. This showcases the acceptance of Taiwanese textile products by world-class athletes.

The heart of this textile cluster is located in New Taipei City. Notably, the BSI group operates a factory in nearby Guishan, Taoyuan. This proximity to the cluster allows Big Sunshine to better serve its customers and stay abreast of the latest industry developments.

-Mission critical consumables

On Twitter I have consistently expressed my preference for companies that sell consumables. The nature of consumables offers several key advantages:

Less effort is needed to find new customers, resulting in lower marketing costs.

Predictable demand simplifies decisions related to sourcing, purchasing, inventory management, warehousing, distribution, hiring, and employee training.

Enhanced end-user feedback.

Improved product development and optimization.

A cooperative, rather than transactional, relationship with customers.

If the consumable is also mission-critical, that is even better. When a product is crucial to the end user's process, the importance of smooth production far outweighs any potential savings from using cheaper alternatives. End users are reluctent to switch, creating an exceptionally strong moat.

Textile auxiliaries fit this description.

-What are textile auxiliaries

Textile auxiliaries are chemicals used throughout the textile manufacturing process. This process can be best illustrated in the following chart.

Textile auxiliaries can be categorized into three main types: 1) Pretreatment, 2) Dyeing, and 3) Finishing.

Pretreatment: Yarns or threads are placed into a loom to form fabric, but before this, they need to be sized (starch-coated) to withstand the shedding, picking, and battening motions of the loom. Once the fabric is made, it needs to be desized and bleached. Additional treatments are then applied to improve dye uptake and reduce shrinkage. Depending on the material, required auxiliaries may include starch, lubricants, scouring agents, penetrating agents, wetting agents, detergents, and more.

Dyeing: The fabric is then ready for dyeing. Chelating agents are used to remove calcium and magnesium from the water. Dispersants ensure dyes are spread evenly, while leveling agents help dyes gradually attach to the fibers and move from areas of higher concentration to less concentrated areas. Finally, fixing agents are applied to ensure the dyes adhere to the fabrics.

Finishing: At this stage, different functionalities can be added to the fabrics, such as wrinkle-proofing, shrinkage resistance, anti-static properties, fire retardancy, waterproofing, and high UV protection. Products involved in this stage include softening agents, waterproofing agents, antistatic agents, and others.

There are additional factors to consider when applying auxiliaries. Each type of fabric behaves differently. For example, nylon requires high pressure and acid dyes, while polyester, being more compact, needs higher temperatures and pressure, and uses disperse dyes. Consequently, the auxiliaries used will differ.

Original Design Manufacturers (ODMs) may seek treatments that are more water- and energy-efficient. Brands might also require ODMs to use chemicals that meet environmental standards, such as Bluesign or ZDHC certifications. These dynamics create numerous opportunities for auxiliary companies to upsell and offer niche products.

Auxiliary companies work closely with textile ODMs, providing technical support, training, and troubleshooting services. The knowledge gained during troubleshooting accumulates over time, creating a significant advantage. Switching auxiliaries would require starting the trial-and-error process all over again. As fabric technology continues to advance, the role of auxiliaries has become increasingly crucial, deepening the involvement of auxiliary companies in the production process.

-Company history

It is clear that a successful auxiliary company must possess deep knowledge of how dyes work, as well as a strong understanding of the supply chain ecosystem. Big Sunshine is well-positioned in both areas.

Big Sunshine is a member of the BSI Group, which was founded in 1988 by Mr. Kun-Mu Chen. The group began by selling wool yarns before pivoting into dyes and auxiliaries manufacturing. They have established various joint ventures with Chinese chemical companies. Core R&D employees were recruited from Nanya Polyester, Everest Textile, and FCFC. BSI Group achieved Bluesign certification in 2010 and ZDHC certification in 2017. Sports brands that have partnered with BSI Group include Nike, Under Armour, Adidas, Li Ning, Anta, 361, Peak, and Qiaodan. Here are links to BSI’s product catalogs for both dyes and auxiliaries.

Being part of the supply chain for top brands (excluding Qiaodan) is a strong indicator of overall quality and cost performance. These brands conduct stringent tests on color fastness to washing, rubbing, perspiration, and light, ensuring that no detail is overlooked. In recent years, brands have increasingly sought alternative chemicals that are free from substances like formaldehyde, PFOS, and PFOA. The fact that BSI Group holds Bluesign and ZDHC certifications demonstrates their ability to provide environmentally friendly solutions to their clients.

In May 2020, the BSI Group completed a reverse merger, integrating Big Sunshine's operations into 1475.TW. The current 1475.TW should be seen as the auxiliary sales arm of the group rather than a full-fledged manufacturer. A typical manufacturer would have substantial production and R&D departments, leading to higher SG&A expenses. In this case, 89% of 1475's purchases are from affiliates. If related-party transactions are not your preference, this might be a good point to look away.

The CEO of 1475.TW, Mr. Kun-Mu Chen, wrote a paper titled “A Case Study of Key Successful Factors and Strategic Development Roadmap in Taiwanese Dyestuff Industry—An Example of JEAN WAN Company” on 2022/01/18 . In which he provides an overview of the BSI group and the dye industry, though there are also some insights about auxiliaries.

The auxiliary business involves selling comprehensive dyeing and finishing solutions. It requires providing end users with meticulous technical support and training operators. A well-rounded product mix covering pretreatment, dyeing, aftertreatment, and finishing is essential, as well as patience and time to work with employees on the floor. Field service technicians need to be available when needed. Color formulation and color matching are also part of the job.

Sub-scale competitors lack a complete product mix or strong technical support. One formidable player in this space is Longsheng. However, according to Mr. Chen's paper, they have a high churn rate among sales representatives. Employees working in R&D are not well-paid, and top-notch engineers do not stay long. Additionally, the technical support and service are probably not as attentive when the main goal is chasing profit and efficiency. In short, there is white space for BSI to add value.

-Limited coverage

Listed companies in Taiwan disclose the number of shareholders every week. As of 8/23, only 163 people own 15,000 shares (worth approximately USD 29K). This is a very low number. Reverse mergers do not receive widespread reporting, and there are negative connotations associated with them: why didn't they go through a normal listing process and have everything properly vetted? Also, the Taiwanese investing community is unfamiliar with textile auxiliaries and probably less inclined to research them in depth. The company name "Big Sunshine" does not sound particularly inspiring either.

These factors contribute to the limited coverage of Big Sunshine. However, through public filings, the aforementioned paper, and product catalogs, there is sufficient evidence suggesting it is a legitimate business.

-Lack of track record

Big Sunshine, in its current form, has only existed since May 2020. Investors will need to accept the lack of track record. There is insufficient evidence to support or disprove that the company will treat shareholders well. However, if they intended to engage in questionable practices, bringing Big Sunshine to the public would defeat the purpose. Three years ago, there was a public offering, issuing 10 million shares at $26.8; at the announcement, the stock price was $35. This does not appear particularly shareholder-friendly or unfriendly. Since the reverse merger, there have been no abnormal increases in sales or management expenses. There is also no unusual capital expenditure. The Taoyuan factory, which they acquired in February this year for NTD 189M, seems legitimate.

-Comp

In June 2019, an auxiliary manufacturer, 1787 Jintex Technology, was taken private by a PE fund at an EV/EBIT of 11.3. Currently, Big Sunshine is traded at a run-rate EV/EBIT of 8.28. As mentioned before, Big Sunshine benefits from not having production and R&D departments, so its earning power is significantly inflated. Yet, Big Sunshine is part of a group with more resources to leverage, while Jintex operates independently. Although not a perfect comparison, it appears that at the current valuation, there is some value in Big Sunshine.

-Conclusion

This idea represents a niche opportunity that is currently flying under the radar. There is potential value in establishing an early position before broader market recognition. However, given its low profile, investors may have the luxury of patience in seeking a more attractive entry point. Importantly, the critical role of textile auxiliaries in the industry appears underappreciated, presenting a potential edge for informed investors.

I am not familiar with this Taiwanese textile stock - I included a link to your post in my last weeks EM links collection post: Emerging Market Links + The Week Ahead (September 3, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-september-3-2024