Disclaimer(Mr. Michael Fritzell kindly let me use his):

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of One Foot Hurdle and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Nissin Foods(1475:HK) is a subsidiary of Nissin Foods Holdings(2897:TYO) that is trading near a 52-week low albeit displaying strong fundamentals. Net income from 2014 to 2022 grew at a CAGR of 9.2% yet the EV/EBIT is just under 8. The valuation is simply too silly. Nissin Foods also appears to have decent growth space. If someone is willing to stomach ugly headlines and turbulence, I believe it is going to provide good performance.

Capitalization

Share price at 2024/03/15: $4.86

Shares outstanding: 1,044M

Market cap: HKD $5,072M

Enterprise value: HKD $3,648M

Average daily trading volume: HKD $2.2M

Key operating numbers

Company background

Nissin Foods manufactures and sells instant noodles and has a small distribution business distributing Ready-To-Drink juices, coffee, and cookies. Nissin Foods Holdings(2897:TYO) owns 72.05% of Nissin Foods(1475:HK) and this relationship provides 1475:HK a unique opportunity to access valuable resources that are not available to other competitors.

2897:TYO is one of the world's largest instant noodle makers. In the post war era in the 50s the founder Mr. Momofuku Ando discovered that, by deep-frying, noodles' shelf life can be significantly extended and the market had a huge need. He founded the company in 1948, innovated the world's first bag-type instant noodles in 1958 and the world's first cup noodle in 1971. Instant noodles, albeit now often criticized for its high sodium, high carb content, met a need of many consumers as it is cheap, convenient, easy to carry. 2897:TYO has had remarkable growth since the introduction of instant noodles.

Through an innovative mindset and competent stewardship Nissin was able to expand globally into the US, Brazil, India, Germany, Thailand, China, the Philippines, Mexico, and built a strong brand and loyal following. One thing worth noting is that Mr. Momofuku Ando in the 50s found a credit union(信用组合) in Osaka but it bankrupted in 1957 and he lost all of his wealth. Since then he became skeptical about banks and issuing bonds, preferred retained earnings and issuing shares as sources of funding. As a result even today 1475:HK has no debt and lots of cash on the balance sheet.

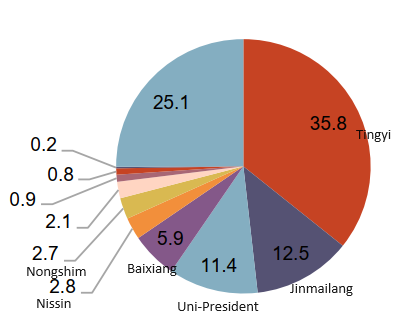

Nissin entered Hong Kong in 1985, acquired local favorite Winner Food(who is known for 公仔麵, "Doll Noodles") in 1989 and that strengthened its market position. They set foot in Zhuhai, Guangdong Province, in 1993 and Shanghai in 1999. Currently Nissin is number six in mainland China with a market share of 2.8%. One important thing to add is that from 2004 to 2015 Nissin was a key shareholder in Jinmailang(No. 2 in market position in 2021 with a market share of 12.5%). Nissin had a front-row seat witnessing the tremendous development of Jinmailang and accumulated valuable market experience.

In 2022 the world consumed 121.2 billion servings of instant noodles(source:WINA), and China is the largest market, with 45.07 billion servings(2.87% CAGR in 2018~2022), in value the Chinese market is about ¥CNY 146B in 2022(source: iiMedia).

Resource from the parent company

One advantage is the scale in purchasing. In the prospectus that Nissin Foods filed in 2017 it states that the products made up 65.7% of COGS. Wheat flour is 11.9%, palm oil is 5.1%, seasoning is 10.2%, packaging is 13.2%, and dehydrated vegetables/meats is 25%. The parent company has a revenue of JPY 669.248B(includes China) in fiscal year 2023, excluding China the revenue is still over 20 times of 1475:HK. 1475:HK can leverage the parent company's buying power to drive the cost down and maintain competitive prices.

Secondly, Nissin is known for its wide range of products. Many products originated from Japan then added a little twist to suit the local market. Although instant noodles are never considered as healthy foods, Nissin in its long history has attempted to introduce healthier alternatives, such as cup noodles that have less sodium, less carbs, and more protein. There is one that is made without deep frying, so fat is considerably reduced. There is also a gamer cup noodle where caffeine and arginine are added for extra energy. The parent company is ahead of the curve, constantly launching products that fit consumers' lifestyle and 1475:HKG can tap into this pool and bring them over to China.

Growth opportunity and noodle consumption

Noodles in China are widely popular. The fact they are made from dough of various grain flours and can be cut/rolled/stretched, creates many forms and texture of noodles. Each region has its own touch and cooking technique and this makes noodles a very versatile cuisine.

Obviously I am not suggesting that all the noodle cuisines can be replicated in instant noodle form but there is room for creativity. Instant noodles are more like snacks. For ¥3 to ¥4 a serving it is an economical, filling option that people are willing to consume when they are on trains, in airports, in tourist attractions where they do not want to get ripped off by local restaurants...etc. For this reason I believe even under the threat of app-based food delivery, instant noodles will still have a place.

So far Nissin Foods' headquarters is in Shanghai, with three factories in Guangdong, Fujian, and Zhejiang. Yet the main noodle markets are the northern provinces and all major players have a serious presence in the North. Tingyi's headquarters is in Tianjin. Jinmailang is based in Hebei. Baixiang is in Henan. Uni-President has production lines in most of the northern provinces(Heilongjiang, Liaoning, Tianjin, Shandong, and Henan). It is not hard to imagine if Nissin Foods decides to make a stronger presence in the North it can create growth.

Competition

The instant noodle market is competitive. Originally from Taiwan, Tingyi(322:HK) is the number one player in this space. Its 2022 revenue is ¥RMB 78.7B with instant noodles contributing 29.6B. Aside from instant noodles, it has a strong Ready-to-drink portfolio including bottled water, black tea, green tea. It has the distribution rights(until 2050) of Pepsi so it also carries Pepsi, 7-Up, Starbucks RTD coffee...etc and sells them through its extensive network. The product portfolio is complete and robust. Tingyi's reach is truly remarkable and I have them in my portfolio. Jinmailang's 2023 revenue is over RMB 20B and it has bottled water too. Also originally from Taiwan, Uni-president's 2022 revenue is RMB 28.3B with instant noodles made up of 11B. It has a strong RTD portfolio including green tea, iced tea, milk tea, juices.

This chart is not perfect but it is still useful. Uni-President(220:HK) 2020 and beyond put instant noodles in a category under food, but it is still mostly instant noodle. Nissin’s numbers include its distribution business, and to convert to RMB I divided the numbers by 1.16, not very precise.

Out of the above Tingyi and Uni-president are listed. Tingyi and Jinmailang are known for more salty and spicy noodles and have a following in second or third tier cities. Uni-president(especially the 湯達人 product, "Master of Broth" ) and Nissin Foods are more mild and subtle. "Master of Broth" is something special - it is rich, has multiple levels of flavor, yet the fat is removed so it is not too heavy. That is probably where instant noodles are heading - more flavor but less calories.

As you can see from the chart, Tingyi and Uni-President have mixed results between 2018~2022. There are many reasons but running businesses during Covid in China is a gauntlet. Disruptions in production/logistic/distribution, stores closed, violent fluctuation in raw material prices...etc. are all common. At the same time Nissin Foods was steadily gaining ground. It mentioned in the 2021 annual report the cup noodles had strong growth and spicy pork bone (tonkotsu) soup flavor drew rave reviews. That popularity translated well into the bottom lines.

Risk

Anti-Japanese sentiment

Apart from instant noodles being unhealthy and under the threat of food delivery, one major risk is the Anti-Japanese sentiment.

There are some Anti-Japanese sentiment in Korea too but the movement in China is on another level. The peak was last August when Fukushima Daiichi Nuclear Power Plant started to discharge water. It is hard to explain why such sentiment is prevalent but I will attempt to give you some color. I used to live in China for four years. From my experience, Chinese social apps are heavily censored. Any sensitive comment will be banned/deleted immediately. For Anti-Japanese sentiment to permeate to some degree is because the CCP let it happen. For what gain it is hard to say.

Unfortunately there is no work around of this issue. Anti-Japanese or xenophobia is part of doing business in China. Tingyi and Uni-President are facing the same issue as well, being Taiwanese. One hopes management's prudent, patient, long-term focused stewardship and wisdom accumulated through the group's history can help the company weather the storms and excel over time.

Hong Kong Stock Market

Hong Kong did poorly in recent years. There are many reasons: 1. Hong Kong is a Special Administrative Region, the jurisdiction does not extend to the mainland. Also there are no class action suits, there are no effective ways to punish bad actors from China. 2. Weak Chinese macro. 3. Decoupling 4. Defaults from major property developers. The biggest reason in my opinion is the lack of corporate governance. This has been lingering for an excruciating period of time, SFC and the exchange accomplished very little. Under the decoupling backdrop the international funds finally had enough and started pulling from the market from late 2022 and onwards.

I caution people who are considering entering into this market. I personally have a position that went over 100+% and I feel it is a good time to sell some and put in Nissin Foods, which is around a 52-week low. If you currently do not have any Hong Kong exposure, I suggest you to think twice. And if you do, put a cap over it and do not add to it.

Conclusion

Once again at EV/EBIT less than 8 you get a great chance to invest in a reputable brand for a cheap valuation operating in a market with an enormous addressable market. The company is reasonably shareholder friendly, from 2018 and onwards the payout ratio is at least 50% and there is a meaningful buyback in 2021. Current valuation is very attractive. I am comfortable putting it into my portfolio.

Very interesting, nice work! Or shall I say... nice wok!

Thanks DaBao! Great write-up.

>> How is the relationship structured between Nissin Foods and Nissin Foods Holding? Is there exclusivity for Nissin Foods to serve the Chinese market?

>> You show quite a small overall market share for Nissin Foods. Is that across the board, or are they stronger in certain sales channels, particular verticals, et cetera? What is stopping retailers to just allocate all shelve space to numbers 1 and 2, and some private label?